charitable gift annuity minimum age

Ad Earn Lifetime Income Tax Savings. You can also provide payments for another individual such as a parent adult.

Charitable Gift Annuities Hadassah

For most organizations its 50 to 65.

. We follow the recommended rates set by the American Council on. That suits most people who are. Up to 25 cash back Minimum Age.

If you choose other people to receive the payments from your annuity their ages at the time of your. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. Give Gain With CMC.

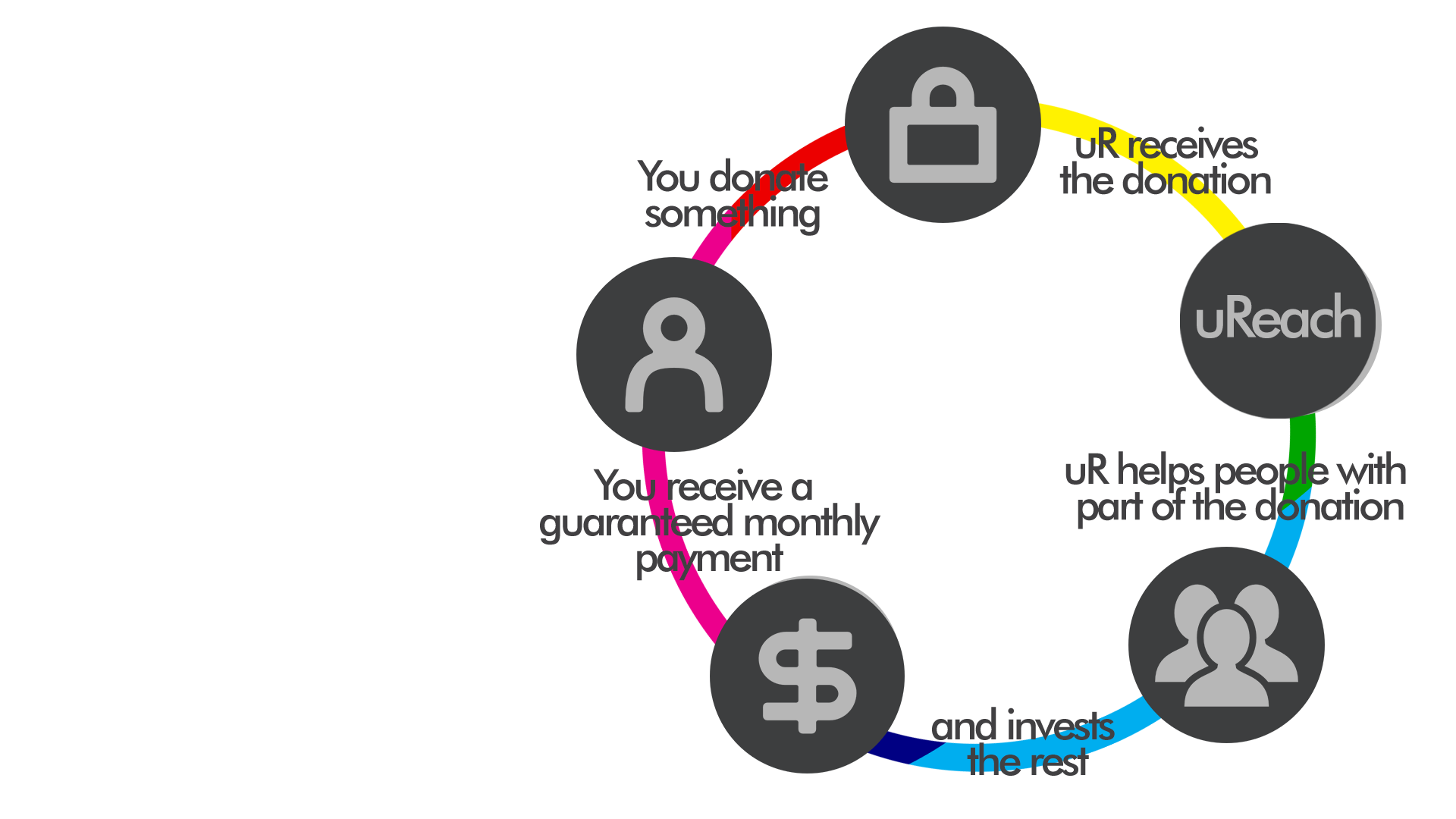

Ad Support our mission while your HSUS charitable gift annuity earns you income. A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. 78 data Organizations whose federal tax exemption was automatically.

Charitable gift annuities also set a minimum age for those wishing to donate. The older you are when you make your gift the greater the payment rate you will receive. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of your life minimum.

The rate for a single 80-year-old is 69. The older you are when you make your gift the greater the payment rate you will receive. The older you are when you make your gift the greater the payment rate you will receive.

125 rows Multiply the compound interest factor F by the immediate gift annuity rate for the nearest age or ages of a person or persons at the annuity starting date. If you choose other people to receive the payments from your gift annuity their ages at the time of. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger.

Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities. Give Gain With CMC. For example a single person who is 70 years old receives a payment rate of 51.

Or you can establish a two-life gift annuity that pays you then a survivor if you choose typically your spouse. Ad Earn Lifetime Income Tax Savings. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property.

Is a Humane Society gift annuity the right choice for you. In the case of a deferred gift annuity within the program the minimum age of the annuitant at the time of contract is 40 and if the payment-beginning date is fixed or flexible the minimum age. 7 rows Many charities require a minimum 10000 to 25000 initial donation to fund the annuity.

That is a portion may. For illustrative purposes a 60-year-old who donates 10000 may receive a rate of 44 paying 440 annually while an 85-year-old will see a rate. If you choose other people to receive the payments from your gift annuity their ages at the time of.

Minimum age to create a gift annuity. SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Age Older Age Rate Younger Age Older Age Rate Younger.

Charitable Gift Annuities Disabled American Veterans

Charitable Gift Annuities Giving To Unh

Charitable Gift Annuities The Michael J Fox Foundation

Charitable Gift Annuity Planned Parenthood

Charitable Gift Annuities Depaul University

Charitable Gift Annuities The Michael J Fox Foundation

Charitable Gift Annuities Giving To Unh

Charitable Gift Annuities Giving To Unh

Charitable Gift Annuity Stewardship And Development

Charitable Gift Annuity Planned Parenthood

Charitable Gift Annuities Giving To Unh

Charitable Gift Annuities Uchicago Alumni Friends

Is A Roth Conversion Right For You Vanguard Roth Conversation Ira

Charitable Gift Annuities Giving To Unh